Story #23

Across the United States, low inventory of homes for sale has pushed sale prices to historic highs. In our popular Metro Denver market, homes that are listed within the first-time homebuyer price range that we looked at last summer are now selling for $50,000-75,000 above the asking price. In this hyper-competitive market, we know that buyers are trying all sorts of tricks to make their offers stand out and get accepted. We strongly discourage waiving your right to inspect the property! The market might be super hot, but don’t get burned.

PROJECT NOTES

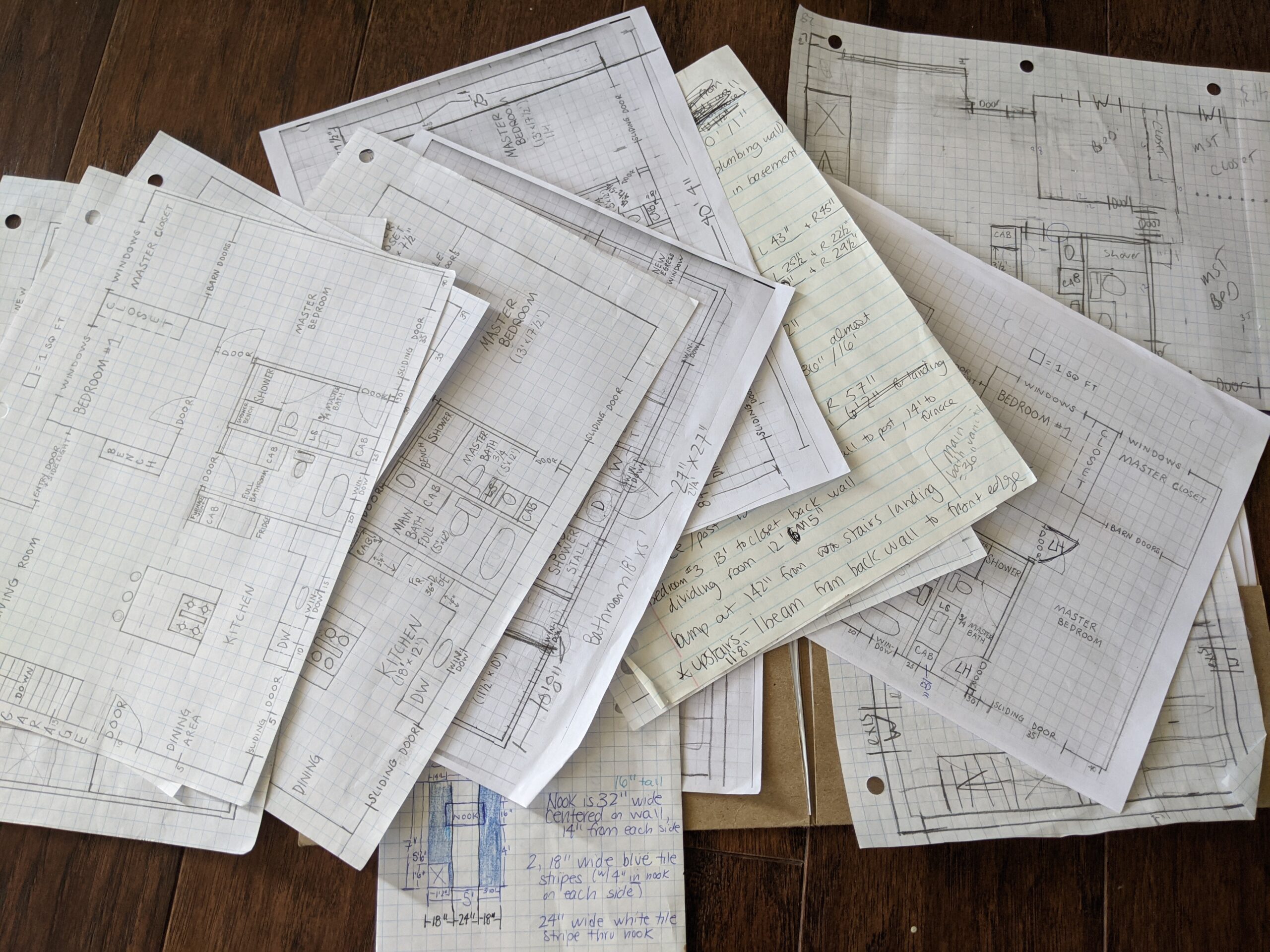

In earlier stories, we shared what’s involved in a home inspection and what the inspection revealed about our first house. In this story, we’re sharing things that any homebuyer can visually, safely check. Josh’s building expertise was really valuable to evaluate the condition of homes we viewed. But even if you’re like Mim was and don’t have construction knowledge, you can spot these clues to potential costly repairs. Whether you’re looking at the listing photos or touring the home in person, keep your eyes peeled for any of these signs that could lead to big expenses.

- What condition are the exterior materials in? If the siding is dented or paint is chipped, include replacing it in your total budget. Even if the outside of the home is in good condition, you should add the cost of changing the color if you strongly dislike it. (Goodbye, peach with baby puke trim!) If there are boarded up windows or the garage door doesn’t open, be sure to count the costs for new ones. Do you spot any rotten wooden boards on decks, carports, or patio covers? If the home has single-paned, aluminum-framed windows, you will want to replace them with more efficient double-paned windows with vinyl or wooden frames. Even from the ground, you may be able to tell if there are curled or missing roof shingles that need to be replaced. The roof should always be inspected by a professional, like a home inspector or roofing contractor, because it can cause damages throughout the house if it’s not performing correctly. In our housing market, roof replacements alone can cost tens of thousands of dollars to fix on a typical home.

- Is the drywall cracked in the corners or doorways? This can be caused by the home’s foundation settling. Structural issues are among the most expensive type of home repair.

- Are there signs of water damage? Look at the top corners of rooms, around the windows and doors, on the basement walls, and the ceiling below the kitchen and bathrooms. If the drywall is discolored, it may be due to leaks or flooding. These stains could be caused by moisture from outside the house getting in or by overflowing toilets, showers, sinks, or dishwashers inside. They may be signs of roof damage, plumbing issues, and potentially rotten wooden framing and subfloors.

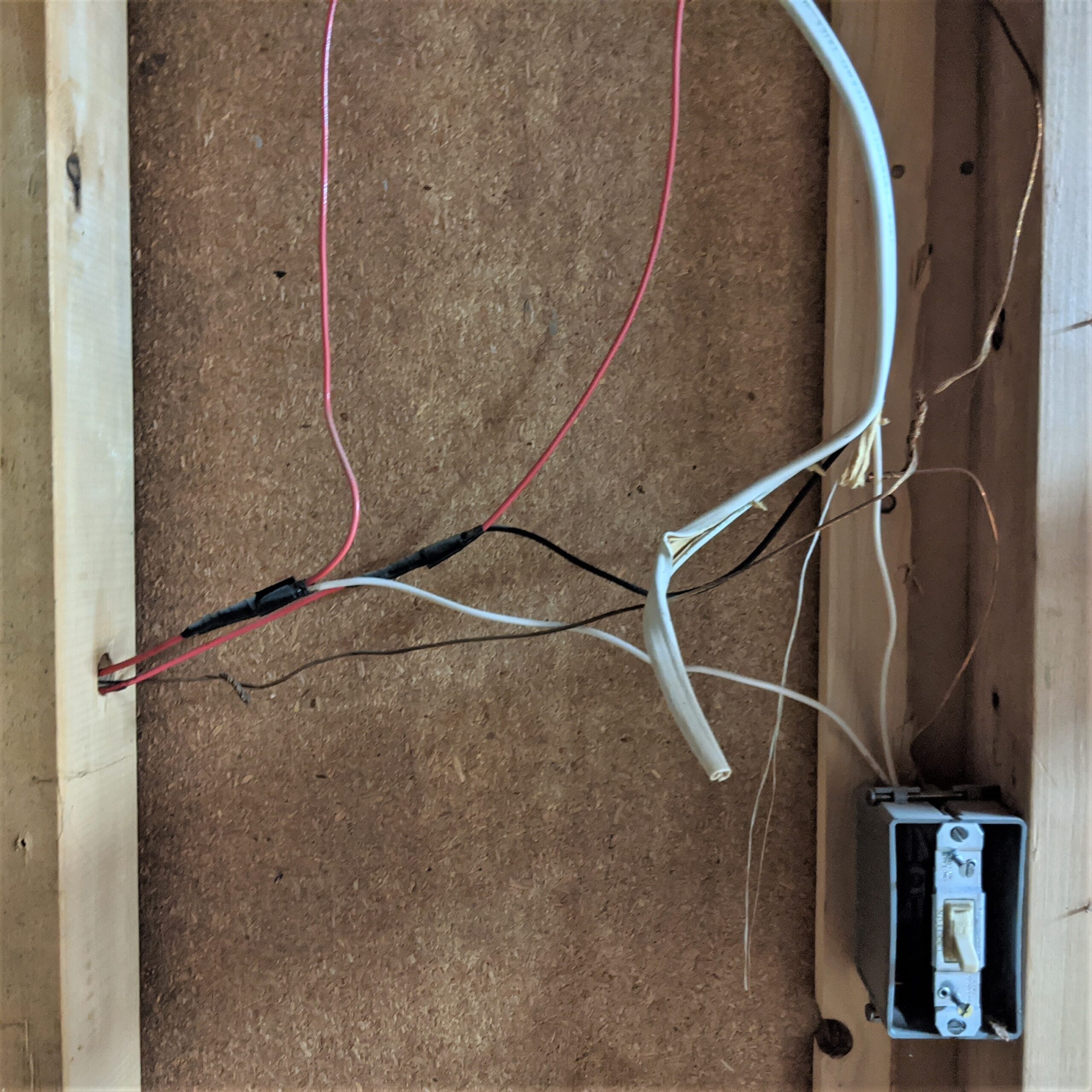

- Do the outlets have 2 or 3 holes? 3-prong outlets have a ground wire. Are there ground fault circuit interrupter (GFCI) outlets with 2 buttons in the kitchen and bathrooms, or anywhere near water? GFCIs can automatically turn off when a fault in the circuit is detected. These are electrical safety requirements in current building codes to prevent you from getting shocked. If a home doesn’t have these outlets, the electrical system may not have been updated recently or it wasn’t done correctly — i.e. by a licensed electrician with a permit and building department inspections. This home could have ancient wiring, like knob and tube, or unsafe DIY wiring by someone who may not know the applicable rules. Updating the wiring throughout the home can be expensive and disruptive. (We took the opportunity to replace our wiring while we framed and moved all the walls in our first house.) You don’t want to pass on this update, though, because faulty wiring is the top cause of home fires.

- Are the breakers in the electrical panel labeled? A sloppy electrical panel is another clue that the home may not have been wired by a trained professional. At a minimum, you will be frustrated when trying to solve problems if breakers pop. We had to update the electrical panel in our 1970s home because we needed more power after we finished the basement.

- What’s the age of the appliances? Are they included? This can help you to estimate potential repair and replacement costs and timelines. Some of the equipment is hidden, so we only replaced those that didn’t work well, regardless of how they looked. Luckily, the furnace in our house is only 11 years old with lots of life left, but the air conditioner was 21 years old, which is past its designed life. Many Front Range homeowners are replacing swamp coolers for the comfort of air conditioners, another expense to consider. We replaced our air conditioner because of its age but also upgraded to a larger unit that could serve the final finished area. We also chose to upgrade from a 40-gal water heater to a tankless unit for the luxury of nearly on-demand hot water. On the other hand, there are other appliances that we considered how they looked as well as how they functioned. The refrigerator, washer, and dryer were all 2-3 years old and good quality, so we kept them. However, we got rid of the electric range/oven, hood, and dishwasher to upgrade to gas and higher quality appliances.

- BONUS: If you can get access to the attic, check if there is insulation to keep your home comfortable.

THINGS WE LEARNED: HOMEBUYER TIP

Homebuyers are pressured to submit offers without an inspection period because they think it will make their offer more appealing to sellers who want to sell their properties without making additional improvements or negotiations. However, our realtor, Laura Gray, explained to us that there are many ways to structure an offer with an inspection. First, we made a short inspection period of 1 week so that owners could quickly find other buyers if we backed out. Then, we set a limit on how much money we’d be willing to spend on any repairs we found before we negotiated changes to our offer amount. For example, we told the sellers that we’d pay for up to $5,000 in repairs before we asked them to fix anything or change their price. This showed them that we didn’t want to nickel-and-dime them and were willing to put work into the property. We also included an inspection rejection clause so that we could break the contract because of an inspection finding without negotiating. These gave us options to calculate a more accurate rehab budget and walk away if there were major issues, like structural problems. Talk with your realtor for other creative ways to reduce your risk of buying a home without waiving the inspection while still submitting a solid offer that will get accepted.