Story #14

If you, like most of us, need to borrow money to buy a house, then a mortgage lender or loan officer should be the first person you contact, not the last call you make when you’re ready to submit an offer. Picking the best mortgage is not the same as comparing prices listed at the gas station. Low interest rates are important, but a great lender will help you understand how to prioritize upfront savings versus monthly savings to best meet your goals, be able to actively support your offer when you’re in a competitive bidding war, and work hard for you throughout the process. Your lender should truly listen to your story so they can guide you through the mountains of documentation, complex regulations, and significant decisions early on. Then, you’ll be able to quickly finalize a loan with the best terms for your specific financial situation when you find the right house.

Why do you want a lender who is working with you from the beginning of your homebuying adventure? The most important reason is because you can complete your loan application upfront to avoid delays during closing. Most sellers want to sell their home fast so they can start the next chapter of their lives. Your lender can provide your mortgage more smoothly and quickly if you’ve already been working together to organize your financial records.

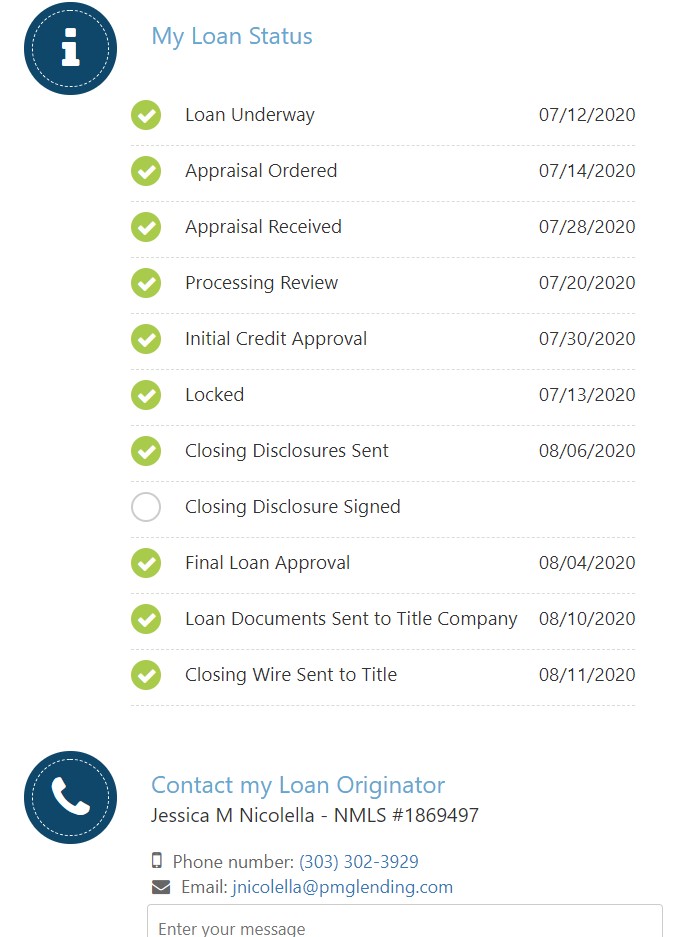

It was easy for us to make that first call to our senior loan officer, Jessica Nicolella, because she’s a dear friend. We wanted to start our real estate journey with Jessica because she’s also a real estate investor, so she understands how to reach financial goals through homeownership. Jessica, now a partner at Greenlight Mortgage Group, taught and supported us through each stage towards closing on the mortgage for our first house. She and her team were available to answer questions on text, email, and phone. Plus, their secure online portal made it simple to upload documents and track our loan status.

Even during unprecedented changes in mortgage regulations because of the coronavirus health pandemic and high volume due to historically low interest rates (July–August 2020), Jessica and her team worked hard to close on our mortgage in 30 days with an outstanding interest rate. This commitment to complete the sale in under a month helped make our offer more appealing to the sellers. As first-time homebuyers, we got peace of mind knowing that the process wouldn’t drag on.

There were several other ways that Jessica helped us to prepare to buy our first home. First, she used a quick review of our credit report and income information to give us a range for the loan and monthly payment amounts; this focused our search on homes we could afford. Later in the process, this amount was refined by the underwriter’s in-depth analysis of our finances for our final loan qualification. She also coached us to improve our loan qualifications while we were still looking for a house. We are fortunate that neither one of us has consumer debt, but not having “enough debt” can also lower your credit score. (Lenders want to see history of borrowing with on time repayment, because that is what you are promising to do when you take out a mortgage.) Jessica advised Josh to get a credit card to build his credit history. He uses it for small purchases and completely pays off the balance each month, so we still don’t have credit card debt.

Jessica’s problem solving skills and genuine curiosity about the plethora of financing products came in handy when we needed an alternate way to demonstrate income. If you are self-employed, like Josh and I, banks typically require 2 years of tax returns as business owners to count that income. We started Beams to Basements in May 2019, so we hadn’t even filed our taxes once when I first talked to her that December. She researched other ways for us to use our assets for the best option. Because we talked with Jessica at the beginning of the process, we had time for a lawyer (who she recommended) to draw up the necessary paperwork before we found a house we wanted to buy. She remained involved through the process and quickly jumped in with 2 more options to navigate the additional requirements that arose during the final underwriting stage.

Finally, it’s important to have a lender who will work hard for you in nurturing special relationships with realtors. In our case, Jessica recommended our wonderful realtor, Laura Gray. They flawlessly shared information about the house and coordinated the required appraisal with the sellers, without bothering us. Other times, realtors may recommend their preferred lenders. Their history of smooth transactions can help your offer to be selected in multiple-offers situations like ours. Jessica went above and beyond to help us get our first offer accepted—and she works this hard for clients who aren’t friends yet, too! She called the seller’s realtor to tell them how solid our financing was. We’re sure this is one of the reasons our offer was accepted.

HOMEBUYING TIP

DO NOT open a new credit card in between your offer being accepted and finalizing your loan. I had already started remodeling our new house in my mind, so I know you may want to pick out new appliances or furniture, too. These items are sometimes backordered for several months, so you want to get them as soon as possible. Plus, those stores tempt you with no money down & 0% interest for the first year! But a credit card application can affect your credit rating and underwriting of your mortgage. In the worst case, it can make your financing fall through. So, we patiently waited to buy our new range/oven and dishwasher until the first weekend after we closed on our house.

OTHER STORIES